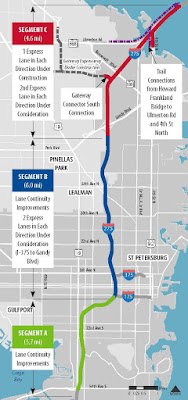

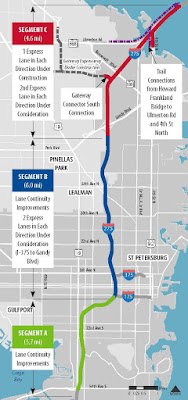

The Florida Department of Transportation held a public hearing for the planned improvements of I-275 in Pinellas County on September 24, 2019. Details of the plans can be found

here, which encompass improvements to I-275 from 54th Avenue South north to 4th Street North in Pinellas County. This was the public hearing for review and comment for the Project Development and Environmental (PD&E) study conducted for the 16.3 mile corridor. Operational improvements, location, design, social, economic and environment impacts of the improvements were analyzed in the study.

|

| I-275 Study Corridor |